Cash is royalty, and you MUST be smart in how you manage it. Unfortunately, SaaS budgeting and financial planning is complicated by the many moving pieces conspiring to make financial certainty elusive: user trends and sentiment, broader economic uncertainty, unique regulatory stipulations, and other factors, to mention a mere few.

In this post, we’ll explore how budgeting and forecasting combine to reduce financial uncertainty for SaaS CFOs. We’ll also discuss the importance of planning for the unexpected, accounting for deferred revenue, enhancing your data integration, and much more.

We’ll start by analyzing one of the most important relationships in the world of SaaS finance.

How does budgeting and forecasting help SaaS companies reduce uncertainty and boost ARR and MRR?

Budgeting and forecasting work in tandem to help SaaS companies minimize uncertainty and improve their growth rate, but they do so in different ways. Budgeting helps finance leaders allocate resources for a given period, ensuring there’s sufficient capital for each department’s various projects. Budgeting plays a crucial role in risk management by helping SaaS companies make sure they can handle the fluctuations that can take place in any subscription revenue business.

Forecasting has strategic implications for the budgeting process and reducing overall uncertainty, but has slightly different objectives. These include:

- Projecting revenue growth: Being able to chart your likely monthly revenue and annual recurring revenue (ARR) is integral to both SaaS budgeting and broader FP&A. Similarly, forecasting also helps you anticipate new customers, revenue contraction, and other financial trends.

- Optimizing the billing process: Selecting the best SaaS billing model for your company is essential in reducing long-term uncertainty. Seamless and strategic billing plays a large role in keeping churn to a minimum by providing a great customer experience. Automated forecasting makes it easy to compare the long-term results of different billing models, and automated reporting helps you see which of your current billing options customers prefer.

- Helping you manage cash correctly by growth stage: As a SaaS CFO, you’ll have different priorities and goals depending on what stage of the business lifecycle you’re in. Are you pre-seed or seed and trying to establish a product-market fit? Or are you more mature and working on finetuning your revenue model or even expanding internationally? Forecasting helps finance leaders navigate each growth stage optimally.

By combining SaaS budgeting and forecasting, CFOs can make informed decisions, adapt quickly to changes, and stay competitive. Let’s peel back a few more layers. How else can this symbiotic pair of financial processes improve your company’s financial performance by reducing uncertainty?

Planning for the unexpected with accounting automation

Planning for the unexpected is crucial for SaaS companies. Extrapolating market trends and historical data into the future is one of the major ways forecasting reduces uncertainty for organizations. Automated forecasting also makes scenario planning as simple as entering your starting data and clicking a button.

Running “If-then” scenario tests is central to reducing doubt about your company’s financial future. What if there’s a sudden large-scale churn event? Will your cash on hand cover your needs while your subscription revenue recovers? Question-based scenario testing is one of the best routes to certainty for finance leaders.

Accounting for deferred revenue through SaaS forecasting

Since SaaS companies recognize revenue in a unique way, accounting for deferred revenue through SaaS forecasting is vital. Managing the demands of ASC 606 is a big piece of that, and is a much smoother experience with the help of financial automation.

By accurately forecasting deferred revenue, finance leaders can manage their cash flow effectively and avoid budget shortfalls.

Risks of spreadsheet-based budgeting and forecasting

Manual budgeting and forecasting processes pose significant risks to your department’s effectiveness and the health of your whole organization. Manual processes are time-consuming and prone to errors that need to be corrected, wasting even more time and cash. Manual methods don’t allow for real-time updates or adjustments, and inaccurate budgeting and forecasting can lead to financial instability and missed growth opportunities.

None of this bodes well for SaaS companies. Let’s check out financial automation for comparison purposes. Is it better at slicing uncertainty down to size?

Benefits of automating your SaaS budgeting and planning

Automating your SaaS budgeting and FP&A benefits your business in several important ways. Let’s review some of the most important of those.

Slashing manual financial processes.

Automation eliminates manual data entry and calculations, resulting in greater accuracy and reliability.

Centralize your data and streamline workflows.

Integrating all your CRM, ERP, and billing data into a centralized system ensures seamless SaaS forecasts and eliminates the risk of errors.

Unlocking real-time insights and more robust forecasts.

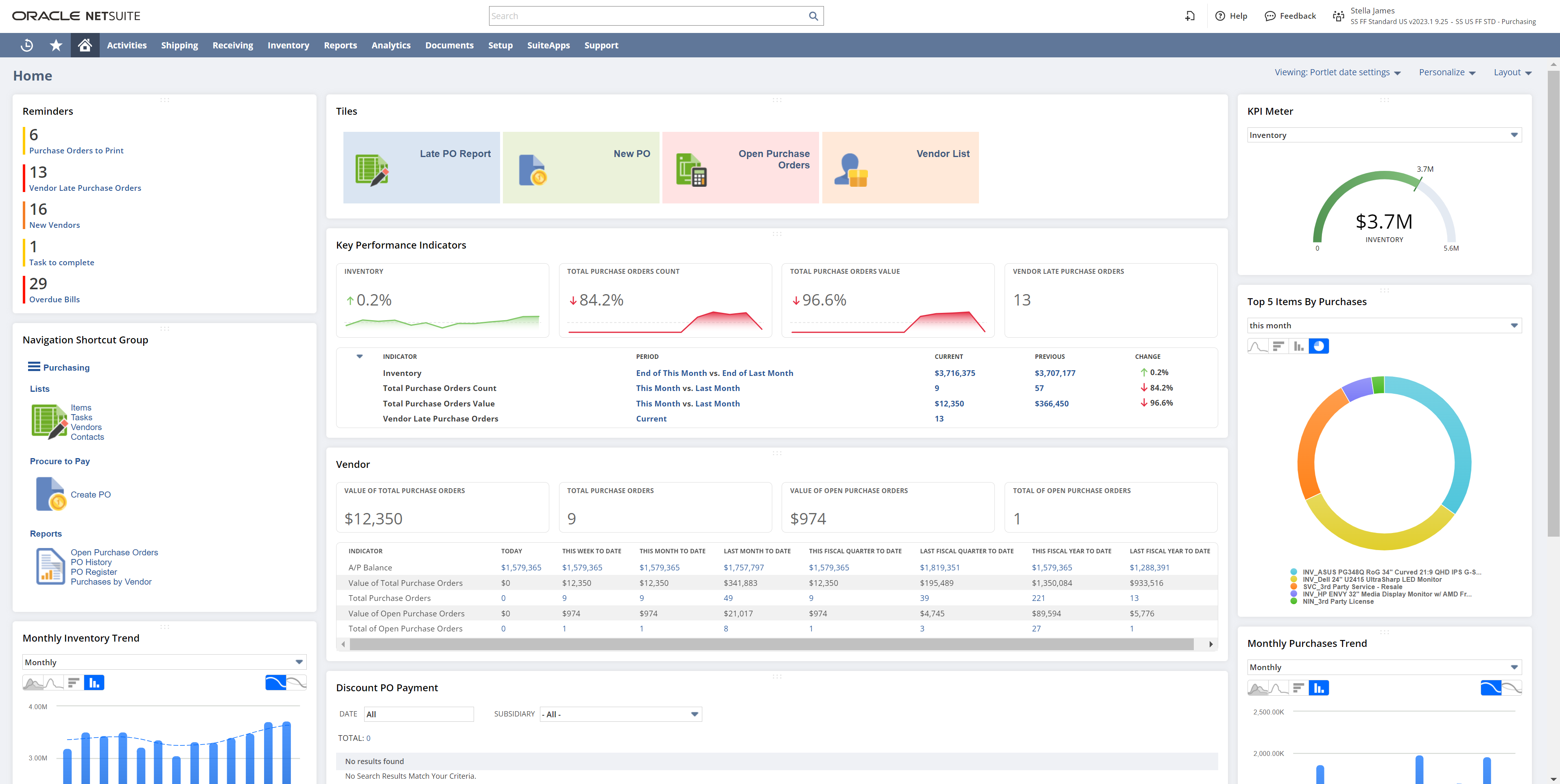

Automated budgeting and planning provide real-time visibility into your SaaS revenue and financial performance, enabling you to make data-driven decisions. Automated forecasting models can generate lower-variance revenue projections by effortlessly incorporating historical data, market trends, and various SaaS metrics.

Investing in automated software solutions for SaaS forecasting and budgeting can significantly enhance your department’s financial planning and growth prospects. However, not all accounting suites are on equal footing.

Cloud-enabled vs. cloud-native financial planning software (and why the distinction matters for your finance team)

Cloud-native and cloud-enabled SaaS budgeting options may sound similar, but there are some essential differences that CFOs need to consider before making a purchase. Let’s briefly compare both types of tech.

1. Cloud-enabled accounting software

Cloud-enabled SaaS budgeting refers to a traditional budgeting solution re-hosted in the cloud. This is known as a “lift and shift” application. Although it sounds innovative, it’s more of a jerry-rigged approach than a true innovation. In practice, cloud-enabled software often isn’t up to the complicated automated workflows that modern SaaS accounting requires.

2. Cloud-native accounting software

On the other hand, cloud-native SaaS budgeting solutions are specifically designed for cloud use. They offer much more flexibility, scalability, and real-time data integration. And unlike cloud-enabled solutions, you’ll never get halfway through a forecast model and suddenly have the whole thing short out on you.

Trusting your company’s budgeting and FP&A to cloud-enabled solutions could ultimately produce more uncertainty instead of less. What else should you consider if you’re looking to embrace automation to maximize your budgeting and FP&A results?

How to automate SaaS budgeting and FP&A

Automating SaaS budgeting and financial planning is essential for helping departments streamline processes and ensure accurate revenue projections. Collaborating with key stakeholders is vital for anything affecting the budgeting process. Budgeting and FP&A impact every team at your company, so even a positive change like automation needs to be discussed inclusively.

But going deeper, what do you need to be mindful of as a SaaS CFO while automating your company’s budgeting and planning?

Integrate CRM, ERP, and billing data for seamless SaaS forecasts

Integrating all CRM, ERP, and billing data is crucial for reducing uncertainty with seamless SaaS budgeting and forecasts. By centralizing and analyzing customer relationship management (CRM), enterprise resource planning (ERP), and billing data, you have all the data you need for decision-making in one spot.

Financial data integration enables accurate revenue forecasting, efficient resource allocation, and optimized marketing efforts. Cloud-native accounting software automatically pulls all your data together in the deployment process.

Identify vital KPIs (and potential problems) for optimized SaaS forecasting

You need to identify the key profit drivers behind your business to fine-tune your forecasting and ensure low-variance predictions after the switch to automation. You can make truly impactful decisions by delving into factors such as customer acquisition costs, churn rates, and average revenue per user, and determining which one has an outsized effect on your company’s performance. Automated role-based dashboards put all the metrics you need right at your fingertips.

After identifying your profit drivers, remember to prioritize them in your forecasting efforts. Additionally, analyzing historical data and mapping out trends while they’re still young allows you to uncover underlying issues or areas for improvement.

Use SaaS metrics to predict bookings, downgrades, churn, and more

Remember to forecast expansions and upgrades, downgrades, and churn in your SaaS business by leveraging the correct metrics. Automated forecasting is extremely powerful, but it’s only as effective as the data you feed it.

Specifically, remember to leverage these core KPIs:

- Expansion & contraction MRR: Your monthly recurring revenue (MRR) tells you the amount of committed subscription revenue you have each month. Your expansion and contraction MRR are essential subsets of that. Expansion MRR tells you how much money you gained in a given month through subscription upgrades and account expansions, while contraction MRR tells you how much you lost to downgrades.

- Voluntary & involuntary churn: Churn occurs when a user unsubscribes from your service, and there are two different types. Voluntary churn is when someone purposely unsubscribes, but involuntary churn occurs when a user’s payment method lapses and they fail to update it on time. Automation plays an important role in minimizing both varieties of churn.

- CAC to CLTV ratio: A SaaS company’s customer acquisition cost (CAC) indicates the average cost of obtaining each customer, while the customer lifetime value (CLTV) tells you how much each customer spends before churning. Both are essential metrics in their own right, but an outstanding CAC to CLTV ratio is the true benchmark of superior performance.

Now we’ll look at five actionable tactics you can use to slash uncertainty for your SaaS business.

Forecasting and budgeting to cut uncertainty: a quick template for CFOs

Now that you know more about automating your SaaS budgeting and financial planning successfully, here are five tips for cutting financial uncertainty through forecasting and budgeting.

1. Plan accurately for revenue recognition on multi-year contracts

Accurately planning for revenue recognition on multi-year contracts is essential for SaaS companies. These contracts can be complex, as revenue recognition may occur over a long period with multiple layers of service obligations to consider. Automation makes it easy to keep track of deferred revenue waterfalls and their impact on your budget.

CFOs need to carefully review the terms of these contracts and determine the appropriate timing and method of recognizing revenue. Be mindful of potential changes or risks that could impact the revenue recognition process: contract amendments, changes in market conditions, or similar factors. By accurately forecasting and budgeting for revenue recognition, CFOs can reduce uncertainty and ensure their business remains financially stable.

2. Centralize and automate to eliminate shadow IT

One of the most important reasons to integrate and automate your financial data is that it helps you boost your cash flow by cutting shadow IT. Any application that your company no longer uses but unintentionally keeps paying for is considered shadow IT.

Enterprise subscriptions can get quite pricey, and neglecting even a few recurring subscriptions can produce a sizable hit to your cash flow. Centralizing your data in the cloud puts everything in front of you, allowing you to see what you need and don’t.

3. Get granular about your pipeline performance and your various sale cycles

Analyzing and breaking down your sales cycles into smaller segments allows you to identify trends, patterns, and key metrics that impact your sales performance. This enables you to make data-driven decisions based on the specific dynamics of each sales cycle, including seasonality, customer behavior, and market trends.

Also, give your pipeline a closer look. Are there parts of it that are converting particularly well, or any spots that could use some help?

4. Aim for a slow burn (especially in a recession)

Your SaaS company’s burn rate is one of the most essential metrics for ensuring positive cash flow. Essentially, your burn rate tells you your total expenses: how much money are you spending each month, and how long can you keep that up with the cash you have available?

5. Think ahead and prioritize seamless scaling

When scaling your SaaS business, thinking proactively and planning ahead for seamless growth is essential. By selecting SaaS solutions built to accommodate future growth and increased demand, you can avoid the constant need to switch and upgrade software.

Get revenue forecasting and budgeting advice from SaaS finance and accounting pros

Optimizing your revenue forecast activity, sales pipeline projections, and budgeting processes are all essential to cutting uncertainty to the absolute minimum. For SaaS CFOs, automation is the most straightforward pathway to doing that because it integrates your data, finetunes your forecasting, and equips you with robust financial analytics all in one fell swoop. But do you and your team know how to work with these tools in the first 90 days post-deployment and beyond? How to scale in a sustainable way that matches the needs of your growth stage? How to confidently build and forecast different billing models?

All of this plays a central role in reducing financial uncertainty for SaaS organizations. If you want to learn more about managing uncertainty and winning your market, the Modern SaaS Finance Academy has what you want. Featuring dozens of cutting-edge digital lessons taught by SaaS finance and accounting pros, you’ll learn everything from automating and forecasting different billing models to building the ideal tech stack, mastering financial storytelling, and much more.

You can start learning today by clicking here. Patterned off the success of the Hubspot Academy, but for SaaS CFOs, Controllers, RevOps, FP&A, and CEOs, it is free and offers the option of CPE credits.